Analysis: Czech political parties’ have higher income than their Polish and Slovak counterparts; yet they lack effective oversight

In the period from 2003 to 2013, Czech political parties reported an income amounting to EUR 547 million. Unlike Slovakia and Poland, the Czech Republic did not carry out a reform of political party financing. If it is to be implemented before the next elections, a timetable of works gives the government only six months to adopt it.

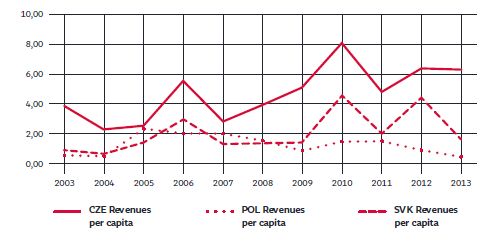

A new data analysis of political parties’ budgets indicates that between 2003 and 2013 all Czech political parties and movements reported a combined income of EUR 547 million, while Polish and Slovak parties earned EUR 560 million and EUR 123 million respectively. The Czech parties’ average annual income in that period was EUR 4.72 (CZK 125) per capita; Poland’s per capita average was EUR 1.32 and Slovakia’s EUR 2.07. Moreover, in comparison with Poland and Slovakia, the incomes of Czech political parties showed a slow but steady upward trend, which indicates that the overall volume of financing spent for the Czech political parties’ campaigns and operation, will continue to grow. In addition, the new act on political party financing will add another approx. CZK 45 million to the funding of so-called political institutes of the parliamentary parties.

Full text of the study (in English) can be found on: https://rekonstrukcestatu.cz/publikace/the-funding-and-oversight-of-political-parties-and-election-campaigns-in-east-central-europe.pdf.

The incumbent coalition government plans that the 2017 elections to the Chamber of Deputies will be governed by an amended law on political parties and election laws. In order to ensure timely introduction of new control mechanisms, such as transparent accounts, extended annual financial statements, and setting up a new office to supervise political funding, the laws must come into force by 1 January 2016 at the latest. This deadline for enacting the new legal arrangements was envisaged also by a plan of the government legislative process. It follows that the government and parliament have only six months to pass the new bill.

Combined per capita incomes of all political parties calculated in euros

An analysis furnished by the NGOs Frank Bold Czech Republic, Frank Bold Poland and Slovak Governance Institute also goes to show the following:

- The share of state subsidies to the Czech parties’ budgets far exceeds the sum of registered donations and amounts on average to 48 percent of their incomes; donations amount to 15 percent of income. At the same time, 58% of all state subsidies went to ČSSD and ODS combined, while 32% of the total was distributed among KSČM, KDU-ČSL, TOP 09 and Public Affairs (VV). The remaining parties received 10 percent of state subsidies.

- Oversight of financing of political parties remains at a low level, but it is virtually non-existent in case of independent Senate candidates like Tomio Okamura, Ivo Valenta or Jan Veleba, whose Senate campaign funding sources remain obscure.

- Experience from Poland, Slovakia or the Baltic States shows that limits for donations or campaign spending will not work without a sufficiently well-established oversight and sanction mechanism.

- Oversight of political parties financing is necessary even in between elections: for example, in the first half of 2013, when there was no election campaign in progress, ODS, ANO and ČSSD spent nine million CZK on publicity, according to Admosphere estimates.

Czech audit and oversight compared with Poland and Slovakia

Unlike Slovakia and Poland, the Czech Republic has no independent supervisory body in place that would keep an eye on the financial affairs of political parties and independent candidates before elections. In comparison with the Slovak and Polish systems, the Czech campaign and financing rules are very general and their breach has never invited financial sanctions to date.

In addition to the absence of a supervisory body, there is no system of really independent audit of the political parties’ books, independent reporting on election campaign funding by party and non-party entities, a system of transparent accounts and a system of sanction mechanisms in place.

The analysis goes to show that a well-devised system of political finance oversight is more important for the transparency and quality of inter-party competition than the setting of spending and income limits.

As shown by experience from the Baltic States (Lithuania, Estonia), prohibition of donations from corporate entities can lead to an increased incidence of masking such donations among private donors (rather than eliminating them). Slovakia imposed limits on campaign spending in 1994–2005, but these were unrealistically low and were thus largely ignored by both parties and the audit body. Poland found itself in the same situation in 1991–2011. Without an effective oversight of campaigns and political parties, any such limits prove symbolic or counterproductive.

The author of the analysis, Frank Bold, is working under the Reconstruction of the State project to actively promote change in legal regulations in the Czech Republic. At present, in the summer of 2015, the Government Legislative Council is discussing an amendment to Law 424/1991 Coll., on association in political parties, and an amendment to the electoral laws.

Increasing transparency of political competition is a trend in all European countries. GRECO, a subsidiary organization of the Council of Europe, focusing on combating corruption, is tackling these issues in its third evaluation round, which in many countries has inspired a reform of laws regulating inter-party competition and election campaigns. European Elections 2019 envisage the introduction of new regulations on campaign funding and the setting up of an independent body that would supervise parties on an EU-wide level. The Czech Republic is one of the few countries which have not carried out any such reform to date.

Party incomes in Czech Republic, Poland and Slovakia in EUR mn (total for 2003-2013)

| Total incomes | Donations | State subsidies | Businesses etc. | Average no. of state-subsidized parties p.a. |

Share of donations in incomes |

Share of state subsidies in incomes | |

| ČR | 547 | 88 | 255 | 204 | 20.4 | 15.1 | 48.0 |

| POL | 559 | 125 | 316 | 118 | 7.6 | 18.2 | 61.7 |

| SVK | 123 | 8 | 90 | 25 | 8.3 | 6.6 | 68.6 |

Additional info from:

Vít Šimral

vit.simral@frankbold.org

+420 606 220 985